Key Points:

- Japan approves additional subsidies of up to 590 billion yen (Approx. $3.89 billion) for Rapidus Corporation to boost semiconductor manufacturing.

- Rapidus aims to mass-produce 2-nanometer chips in 2027, competing with industry leaders like TSMC and Samsung.

- Japan seeks to reclaim its position as a semiconductor powerhouse through significant government investment and support for semiconductor companies.

- Major players like TSMC, Micron, and Samsung are expanding their presence in Japan with government backing to diversify supply chains and foster innovation.

Japan has announced additional subsidies of up to 590 billion yen (Approximately $3.89 billion) for chipmaker Rapidus Corporation to bolster the country’s semiconductor manufacturing capabilities. The move comes as Japan aims to catch up with other leading nations in the global semiconductor market.

The newly approved subsidies include up to 53.5 billion yen (Approximately $0.35 billion) earmarked for research and development, specifically on back-end processes like chip packaging. Rapidus Corporation, established in 2022 by the Japanese government and eight domestic companies, is tasked with developing and manufacturing advanced semiconductors. Major investors in Rapidus include Toyota Motor Corporation and Sony Group, among others.

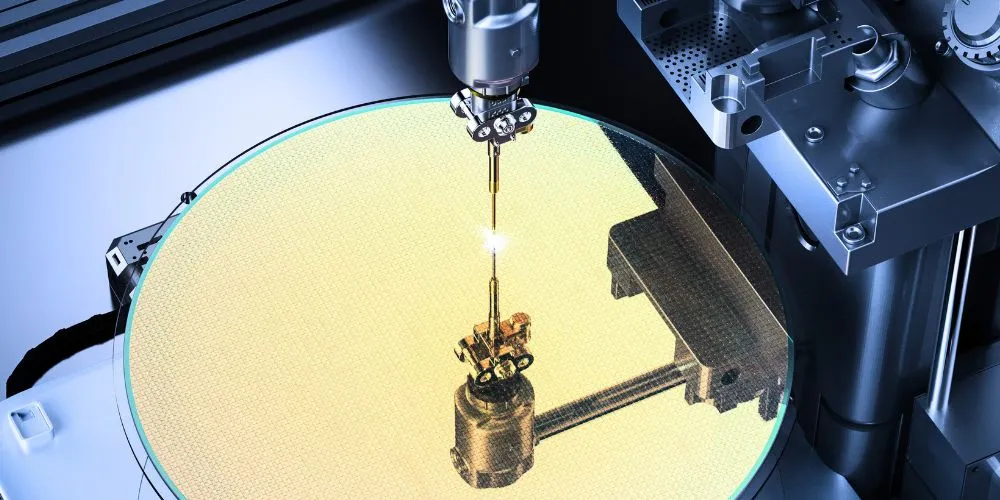

Having received 330 billion yen (Approximately $2.17 billion) in government funding between 2022 and 2023, Rapidus is set to commence mass production of 2-nanometer chips in Chitose, Hokkaido, starting in 2027. This initiative positions Japan to compete with industry giants such as Taiwan Semiconductor Manufacturing Company (TSMC) and Samsung Electronics, which plan to commence mass production of 2-nanometer chips by 2025.

While TSMC and Samsung currently produce 3-nanometer chips, Rapidus is constructing an advanced semiconductor plant in Chitose. The reduction in nanometer size typically results in more powerful and efficient chips, accommodating more transistors on a single semiconductor. Rapidus has initiated research and development efforts in collaboration with IBM, aiming to enhance its technological capabilities in semiconductor manufacturing further.

Japan’s pursuit to reclaim its position as a semiconductor powerhouse, once dominant in the 1980s, has led to significant investment support from the government. In recent years, Japan has extended support to attract domestic and foreign semiconductor companies like TSMC, Samsung, and Micron.

TSMC, with government support, opened its first chip plant in Japan in February, diversifying supply chains away from Taiwan amid escalating U.S.-China trade tensions. Micron announced plans to introduce extreme ultraviolet technology to Japan to manufacture its next-generation dynamic random access memory chips, investing up to 500 billion yen (Approximately $3.29 billion) with government backing.

Additionally, Samsung is set to receive subsidies of up to 20 billion yen (Approximately $0.13 billion) to establish a new R&D facility for advanced semiconductors near Tokyo. These initiatives underscore Japan’s commitment to revitalizing its semiconductor industry and remaining competitive globally.