Key Points:

- BMO Capital Markets raises Alphabet’s stock price target from $215 to $222.

- Alphabet’s Search share increased by 310 basis points globally. Effective AI capabilities are driving growth in Search and YouTube businesses.

- Analysts predict a 20-40 basis points increase in YouTube revenue for 2024, with potential further gains if TikTok ad spending decreases.

- Google Cloud is expected to grow by 28% in 2024, driven by dual-cloud adoption and generative AI workloads.

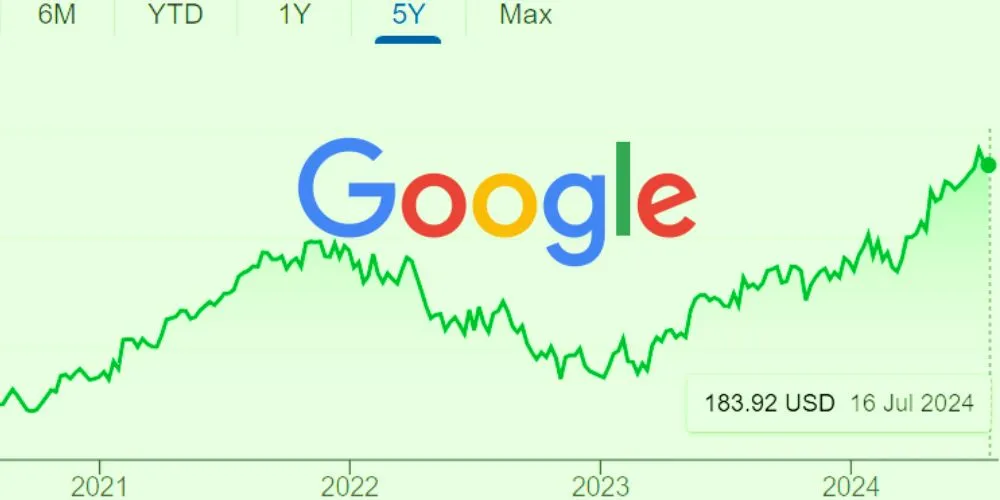

BMO Capital Markets analysts have raised their price target for Alphabet (Nasdaq: GOOGL) stock from $215 to $222, reflecting increased optimism for the tech giant’s Search and YouTube businesses, driven by effective AI capabilities.

Over the past year, Alphabet’s Search share has grown by 130 basis points in the U.S. and 310 basis points globally. Analysts attribute this growth to the rise in repeat query behavior, facilitated by the widespread adoption of chatbots embedded in most apps, which has led to more frequent user returns.

For YouTube, the analysts forecast a 20-40 basis points increase in their 2024 Net Revenue estimate, assuming that TikTok ad spend is reduced by 15-30%. A 50% reduction in TikTok ad spending would provide a 60 basis points boost to YouTube revenue. A complete 100% reduction would lead to a 90 basis points increase relative to the current forecast.

YouTube’s growth is further bolstered by Google’s AI tools, including features like direct video upload from Studio mobile, the expansion of YouTube Create from 8 to 21 countries, auto-conversion from long-form to short-form content, and new ad tools for creators to monetize through AI capabilities. These enhancements have increased user engagement and contributed to continued share gains.

BMO analysts also predict a significant boost for Google Cloud, driven by increased dual-cloud adoption among enterprises. They model a 28% growth for Google Cloud, with potential upside in the second half of 2024 due to growth in generative AI workloads and easier comparisons relative to the year’s first half.

The investment bank has modestly increased its estimates for Google’s 2024 and 2025 Search revenue to $196 billion and $217 billion, respectively, up from $195 billion and $216 billion. Additionally, they now expect YouTube revenue to reach $37 billion in 2024 and $43 billion in 2025, compared to their previous estimates of $36.5 billion and $42 billion.