Key Points:

- Raspberry Pi is raising £166 million from its IPO, pricing shares at 280 pence each. The company is valued at approximately £541.6 million.

- The IPO is a rare win for the London Stock Exchange, which has struggled to attract tech listings.

- Raspberry Pi was founded in 2012 to make computing more accessible. Initially popular with hobbyists, 72% of sales now target the industrial market.

- Raspberry Pi reported revenues of $265.8 million in 2023, a 41% increase from 2022.

British computing startup Raspberry Pi is set to raise £166 million ($211.2 million) from its initial public offering (IPO) on Tuesday, marking a significant win for London’s main stock exchange, which has faced challenges in attracting technology listings.

Raspberry Pi, known for its tiny single-board computers, has priced its shares at 280 pence each. Trading will commence on the London Stock Exchange once the market opens. This pricing values the company at approximately £541.6 million.

Although Raspberry Pi’s valuation is modest compared to larger tech firms, its IPO could revitalize the London bourse, which technology companies have recently overlooked in favor of other European markets and the United States. Notably, Softbank-owned chip designer Arm, despite being headquartered in the UK, opted for a US listing last year.

Several high-profile industry leaders, including Arm and Sony, backed the IPO. The previous year, Sony Semiconductor Solutions, a subsidiary of Sony Corporation, made an undisclosed investment in the British startup, further endorsing its potential.

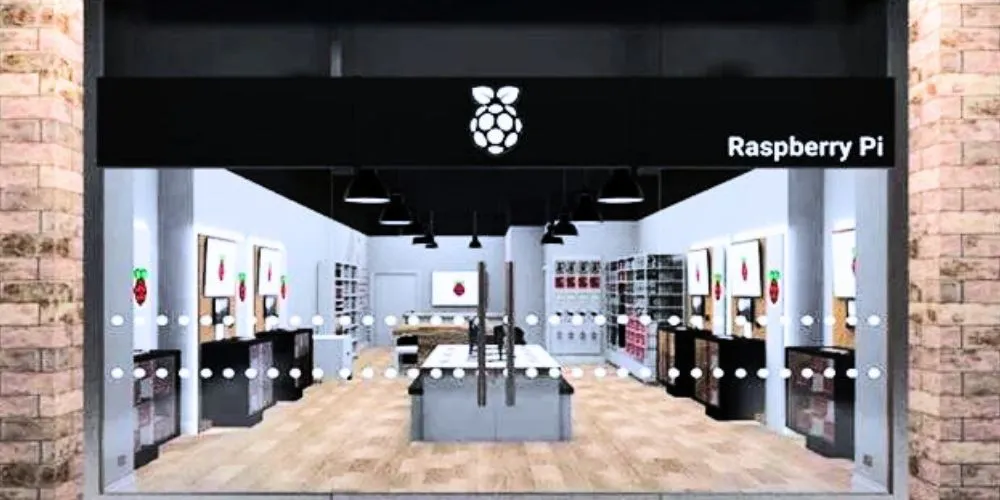

Raspberry Pi was founded in 2012 to make computing more accessible to young people. The company’s single-board computers have various applications, from educational tools to industrial uses. Initially popular among hobbyists, Raspberry Pi has since expanded its reach significantly. Currently, 72% of its unit sales are directed toward the industrial market, where its products are utilized in various settings, including factories.

In 2023, Raspberry Pi reported revenues of $265.8 million, reflecting a 41% increase from the previous year. This growth underscores the company’s expanding influence and the increasing demand for innovative products.

The success of Raspberry Pi’s IPO is a promising sign for the London Stock Exchange, which has struggled to attract tech firms in recent years. The listing could serve as a catalyst, encouraging other tech companies to consider London a viable option for raising capital and gaining market visibility.

The company’s ability to secure substantial investment and steady revenue growth demonstrates its robust market position and the potential for future expansion. As Raspberry Pi begins its journey as a publicly traded company, it remains committed to its original mission of making computing accessible while continuing to innovate and cater to a diverse range of markets.