Key Points

- Congress passed a temporary spending bill to avert a government shutdown. Republicans face internal divisions over extending tax cuts and managing debt.

- Planned tax cuts could add $4 trillion to the national debt by 2025. Political deadlock raises concerns about another downgrade in the U.S. debt rating.

- Debt ceiling negotiations and funding deadlines will dominate fiscal debates in 2025.

- Trump’s proposed tax cuts face significant hurdles despite Republican majorities.

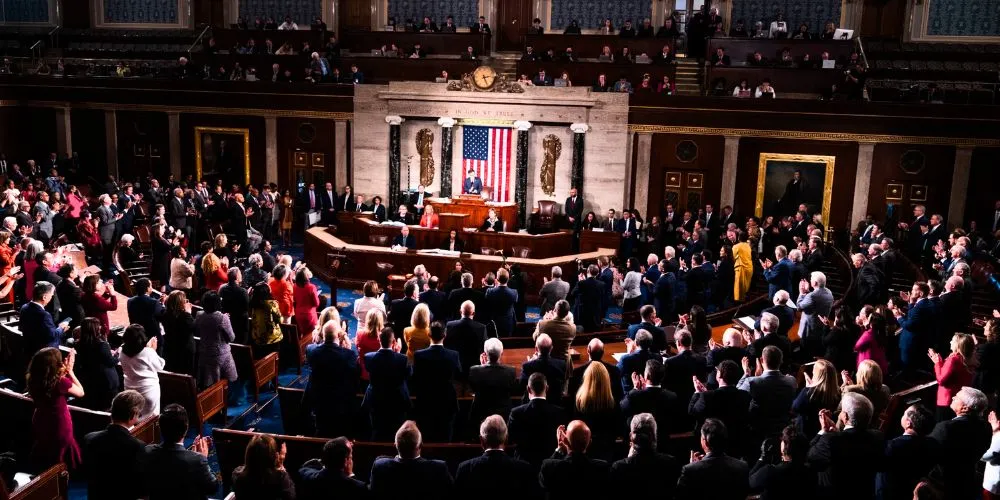

Relief spread through Washington, D.C., as Congress passed a short-term spending bill on December 21, averting a government shutdown. However, the contentious budget negotiations hint at potential fiscal chaos in 2025, including another U.S. debt downgrade risk. Donald Trump will assume office on January 20, with Republicans controlling both houses of Congress. This Republican trifecta raises hopes for extending major tax cuts to expire in 2025 and curbing government spending. Yet, internal divisions within the party and recent budget conflicts cast doubt on the feasibility of such plans.

Despite their House majority, Republicans are divided. Over 30 fiscal conservatives oppose measures that significantly increase the national debt, which now exceeds $36 trillion. While the December 21 bill passed the House with bipartisan support, such unity is unlikely once Trump takes office. Starting January 3, Republicans will have a slim five-seat majority, making it challenging to pass partisan legislation without unanimous GOP backing.

Republicans are drafting substantial tax cuts for 2025, including extensions of the 2017 individual tax reductions and new proposals like eliminating income taxes on tips. However, these cuts could add $4 trillion to the national debt, which may rise with additional tax breaks. Efforts to offset this through spending cuts are complicated by defense priorities and popular programs like Medicare and Social Security, leaving limited options for reducing the debt.

Past legislative battles underscore the difficulty ahead. In 2017, 12 House Republicans opposed the Trump tax cuts, but the larger GOP majority accommodated such dissent. With today’s slimmer majority, even a handful of defections could derail key bills. Recent votes suggest internal divisions, as 38 Republicans opposed a Trump-backed measure to suspend the debt limit.

The upcoming year promises fiscal turmoil, with another funding deadline in March and debt ceiling negotiations likely to spark heated debates. Due to political dysfunction, the U.S. debt rating has been downgraded twice in recent years, and it remains at risk as the national debt continues to climb. While Trump’s tax cuts may eventually pass, the political battles required could further destabilize the nation’s finances.