Key Points

- SMIC’s Shanghai shares have surged 120% since September, outperforming global peers.

- Beijing’s localization push has boosted demand for domestic chipmakers. U.S. restrictions limit access to advanced semiconductor technology.

- Rivals like TSMC may intensify competition by lowering legacy chip prices.

- SMIC shares trade above historical valuation averages, raising overvaluation concerns.

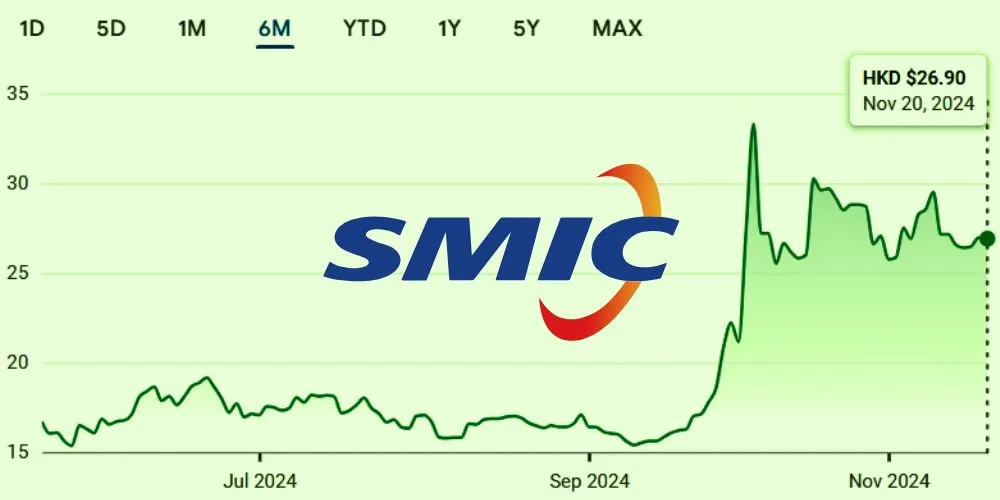

Semiconductor Manufacturing International Corp. (SMIC), China’s largest outsourced chipmaker, has seen its Shanghai-listed shares more than double in value over the past two months. The 120% rise from a September low has outpaced global chip giants like Nvidia and Taiwan Semiconductor Manufacturing Co. (TSMC), fueled by China’s efforts to bolster self-reliance in semiconductor production. However, analysts caution that the stock may be overvalued, given fundamental challenges and geopolitical risks.

SMIC’s mainland stock has outperformed its Hong Kong counterpart by nearly 50 percentage points, reflecting robust demand from Chinese onshore investors. The surge is partly attributed to expectations tied to Donald Trump’s potential return to the U.S. presidency, as his policies may intensify China’s localization drive. Despite these gains, concerns linger over speculative trading and the high valuation of SMIC shares.

China has heavily invested in its semiconductor industry to narrow the technological gap with Western nations. SMIC and other domestic chipmakers, like Hua Hong Semiconductor Ltd., have benefited from Beijing’s stimulus pledges, with Hua Hong’s onshore shares rising 78% since September. SMIC has forecast better-than-expected sales growth this quarter, citing competitive pricing and a rebounding demand for legacy chips in automotive and industrial applications.

However, China remains behind in advanced semiconductor technologies due to U.S.-led export restrictions. These constraints limit access to cutting-edge manufacturing equipment, hampering progress in areas like artificial intelligence (AI) chips. Huawei Technologies Co., for example, has struggled to develop powerful processors under these sanctions.

While domestic demand for chips has supported SMIC’s growth, its valuation appears stretched. The Hong Kong-listed shares trade at a forward price-to-book ratio of 1.2, above the three-year average of 0.9. Analysts argue this is excessive for a cyclical, asset-heavy business like chip foundries.

Rivals like TSMC may lower prices for legacy chips, adding pressure on SMIC’s pricing power. Morgan Stanley analysts predict intensified competition in 2025, which could strain SMIC’s margins. Morningstar’s Phelix Lee also warns that fiscal stimulus may not drive as much long-term growth as markets anticipate.