To rejuvenate its sluggish stock market, Beijing has informally advised major mutual fund managers in China to prioritize the launch of equity funds over other products like bond funds, according to sources familiar with the matter. The guidance, known as “window guidance,” was reportedly provided by the China Securities Regulatory Commission (CSRC) in recent weeks to bolster the country’s capital markets.

The mutual fund industry, valued at $3.8 trillion, is crucial in China’s financial landscape. However, sales, particularly in equity funds, have waned over the past year as stock benchmarks tested multi-year lows.

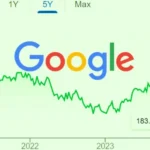

The directive from the CSRC is part of a broader effort by Chinese authorities to uplift the stock market, which has faced challenges from a destabilizing property sector crisis and slowing economic growth. Despite measures, including stamp duty reductions, IPO pace control, encouragement of margin financing, and protection of small investors, China’s stock market performed poorly in 2023. The CSI300 index closed the year with an 11% loss, starkly contrasting with the 20% gain in global stocks.

Sources revealed that the CSRC has required some fund managers, including those at state-backed mutual funds, to launch at least four new equity funds before considering any new bond funds. The regulator has prioritized equity fund launches with no set ratio limit on equity and bond funds.

In 2023, China witnessed a decline in the launch of new equity funds, with 334 introduced, marking a 22% decrease from 2022 and a 49% drop from 2021. The proceeds generated also saw a significant decline. In comparison, institutional-tailored bond funds experienced a more resilient performance, with a 13% decrease in new launches from 2022 but a 14% increase over 2021 in raised proceeds.

As part of the recent push, the private funds sector, boasting assets of approximately 20 trillion yuan, has seen quicker approvals for new equity funds than funds tracking other asset classes in the past two months.

While the CSRC’s directive aims to revitalize investor confidence, skepticism remains about its effectiveness, especially as local investors grapple with diminishing stock market returns. Analysts, such as Xia Chun, Chief Economist at Forthright Holdings Co, express doubt about the significant impact of promoting equity funds in a sluggish market, citing high marketing costs and potentially low effectiveness.

Investors closely monitor how these directives and market dynamics will unfold in the coming weeks as authorities strive to navigate economic challenges and revive the Chinese stock market.