The prevailing pessimism stems from challenges green stock investors face, including the shock of a post-pandemic world with higher interest rates. Additionally, several US states have an ongoing political backlash and an evolving regulatory landscape that could expose greenwashing and further affect valuations.

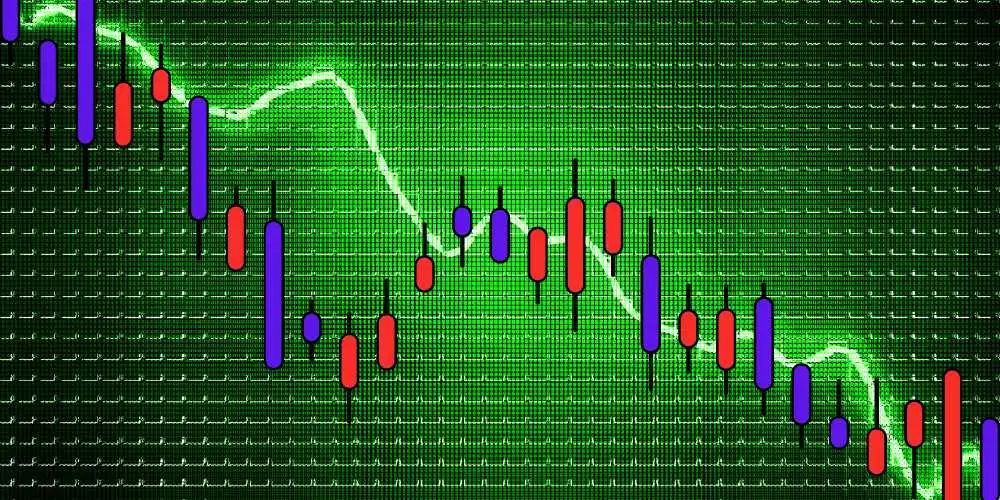

A recent Bloomberg Markets Live Pulse survey indicates that the ongoing selloff in green stocks will likely persist into 2024, marking a fourth consecutive year of losses. The survey reflects a consensus among respondents that the downturn in green assets signifies a “watershed moment” for the industry. Some attribute the decline to excessive speculation and a diversion of focus from traditional financial metrics due to the hype surrounding green initiatives for climate change.

The negative sentiment is anticipated to impact various green asset classes, with Tesla Inc. potentially losing its spot among the top 10 stocks in the S&P 500. Approximately two-thirds of the 620 survey respondents intended to steer clear of the electric vehicle sector. At the same time, 57% anticipate a continued decline in the iShares Global Clean Energy exchange-traded fund in 2024.

Despite the current negativity, respondents differ in their perspectives when the time horizon is extended. Many anticipate the need to shield portfolios from climate risk in the coming years. Some see the current selloff as a temporary shift of capital away from renewables, presenting a buying opportunity for savvy investors.

While green stock markets are currently viewed as inconsistent and overreactive, there is optimism about the inevitable pivot toward greener technologies driven by the urgency of climate change. The survey indicates that investors expect climate change to impact portfolio values over the next three years.

The green stock downturn has been influenced by factors such as higher interest rates affecting traditional ESG stocks, project delays in the clean energy sector due to supply-chain bottlenecks, and the capital-intensive nature of many clean energy companies. The electric vehicle sector, including Tesla, is expected to face challenges in 2024, with battery-powered cars remaining relatively costly.

Despite short-term challenges, the broader shift toward decarbonization and green technologies is recognized as essential. The outcomes of elections in 2024 are seen as significant, given the impact of public policy on ESG factors. As investors navigate the complexities of the current market, the long-term commitment to environmental, social, and governance goals remains a focal point.