In the first trading session of the New Year, oil prices experienced a notable uptick, rising more than 2% amid escalating concerns over potential disruptions to Middle East oil supplies. The surge was further propelled by a recent attack on a container ship in the Red Sea and optimistic expectations of increased Chinese demand.

Brent crude saw a substantial increase of $1.58, or 2%, reaching $78.62 per barrel by 1316 GMT. Simultaneously, U.S. West Texas Intermediate crude rose by $1.56, or 2.2%, reaching $73.21.

A recent assault by Iran-backed Houthi forces on a Maersk container vessel in the Red Sea heightened geopolitical tensions. U.S. helicopter attack sinking three Houthi vessels raises concerns about the Israel-Hamas conflict potentially expanding into a wider regional conflict.

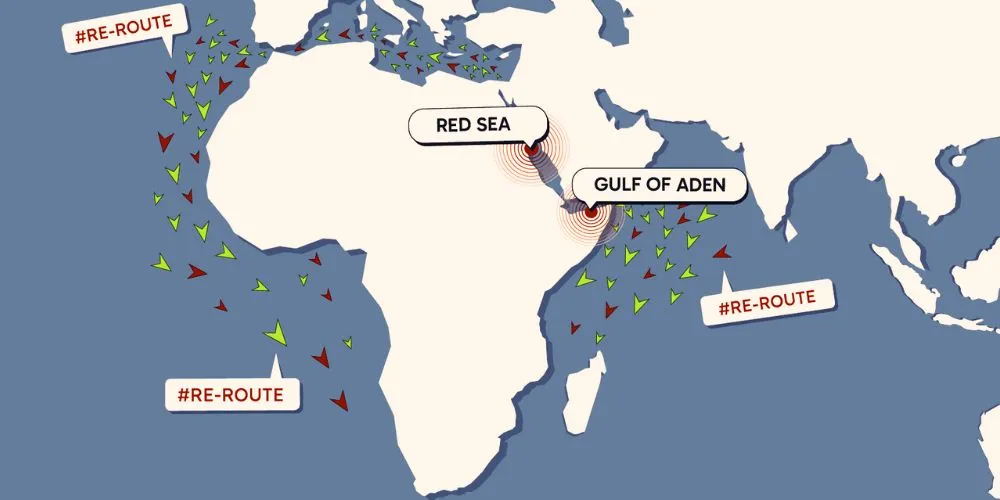

The Danish shipping company Maersk is assessing the situation and will decide on Tuesday whether to resume sending vessels through the Suez Canal via the Red Sea or redirect them around Africa. The possibility of a broader conflict in the region has prompted concerns about the closure of vital waterways for oil transportation. Ship tracking data reveals that at least four tankers carrying diesel and jet fuel from the Middle East and India to Europe are circumnavigating Africa to avoid the Red Sea.

Shanghai-based CMC Markets analyst Leon Li highlighted the potential impact of the Red Sea escalation and the upcoming Chinese spring festival, stating, “The oil price may be affected by the escalation… in the Red Sea over the weekend and the peak demand season during China’s spring festival,” referring to the Lunar New Year holiday in early February.

Additionally, concerns over economic slowdown were heightened in China as government data revealed manufacturing activity contracting for the third consecutive month in December. Investor expectations of fresh economic stimulus measures have risen, potentially boosting oil demand. The situation remains dynamic, and market participants closely monitor geopolitical developments and economic indicators for further insights into oil price trends.