Key Points

- BMW (BIT) shares fell 3.79%, driven by revenue dropping 16% year-over-year and volumes declining 12% due to supply chain issues and slowing demand.

- The company’s adjusted EBIT margin fell to 5.2%, well below the 6-7% full-year guidance, with automotive segment margins at 2.3%.

- Free cash flow decreased by €2.4 billion, pressuring BMW to meet its annual target amid rising R&D spending and inventory levels.

- Analysts predict a recovery timeline extending to 2025, given BMW’s current challenges in China, competitive pressures, and market shifts.

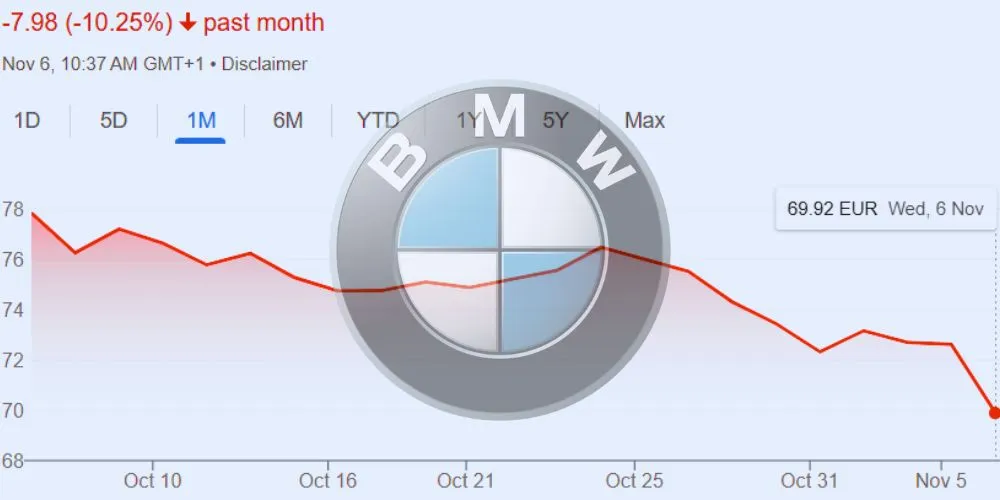

BMW (ETR: BMW) share declined by 2.70 or 3.79% to €69.92 following weaker-than-expected third-quarter results. The automaker reported a 16% year-over-year drop in revenue, reflecting significant pressure across its operations. Volumes were down 12% due to ongoing supply chain disruptions and waning demand in key markets, notably China.

Analysts at Morgan Stanley highlighted the report as “the weakest results in the European OEM space,” citing large pressures in free cash flow (FCF) due to challenges in China and issues related to the IBS (Intelligent Battery System). BMW’s core operating metrics revealed struggles across multiple areas, raising concerns for the company’s short-term performance.

BMW’s adjusted EBIT margin fell sharply to 5.2%, six percentage points lower than the previous year. Within its core automotive segment, margins were down to 2.3%, a significant dip from BMW’s full-year guidance range of 6-7%. This trend indicates increased pressures within the automotive sector and signals the challenges BMW faces in maintaining profitability for its traditional vehicle models.

Free cash flow also took a hit, decreasing by €2.4 billion. With only one quarter remaining in the fiscal year, this setback places BMW under intense pressure to recover to meet its full-year cash flow target of over €4 billion. The company’s increased investment in research and development (R&D) and rising inventory levels have further strained its financial position, necessitating strategic adjustments to close the cash flow gap.

Regarding geographic performance, BMW’s sales in China fell 30% year-over-year, compounding its financial strain. The U.S. market also registered a decline, with sales dropping by 9% compared to the same period last year. In contrast, European sales grew by 4%, allowing BMW to gain market share despite a generally weak automotive environment across the region.

BMW’s transition to electric vehicles (EVs) has shown modest progress, with EVs accounting for 19% of sales in the third quarter, up from 17% in the previous quarter. However, the shift has yet to fully compensate for the downturn in demand for BMW’s conventional models, whose margins have suffered due to factors like the IBS issue, which has disrupted the model mix and added complexity to BMW’s production and inventory management.

Analysts suggest BMW’s recovery may not take hold until 2025 as the company navigates cyclical, structural, and geopolitical challenges, particularly in China. While BMW’s product pipeline remains strong, these pressures raise questions about the automaker’s ability to recover quickly in the face of heightened competition and shifting market dynamics.

Given BMW’s Q3 results, prospective investors should approach this situation cautiously. Analysts project potential recovery by 2025, suggesting the stock might remain under pressure in the short term. Investors should consider diversifying or waiting for clearer signs of recovery before buying BMW shares.