Key points

- New Pixel 10 smartphones, smartwatch, and earbuds launched at the “Made by Google” event.

- AI features include a camera “coach” and a proactive assistant. Prices remain competitive despite industry-wide concerns.

- Introduction of Pixelsnap magnetic charging technology.

- Google’s market share remains relatively small despite the new launches.

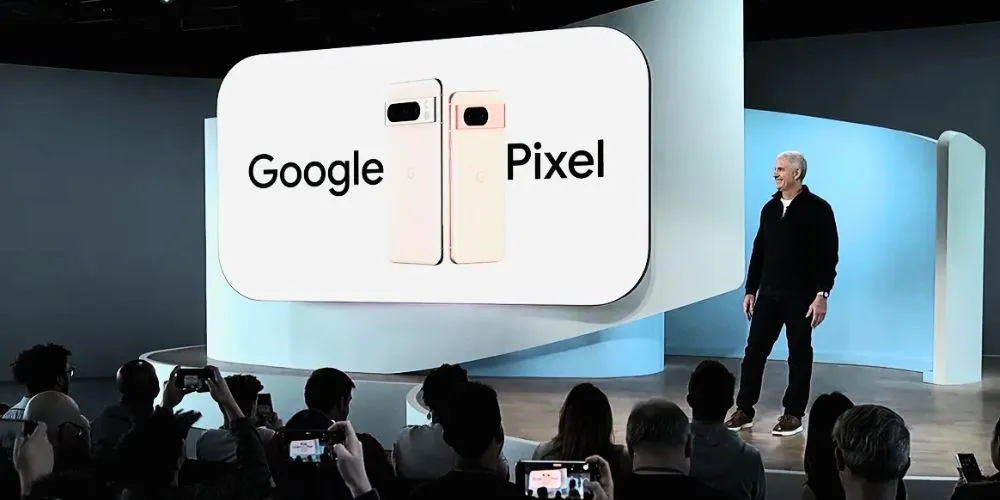

Google unveiled its latest Pixel 10 series smartphones and accompanying gadgets at its annual “Made by Google” event in New York. This year’s launch featured more modest upgrades compared to last year’s bolder showcase, focusing on integrating artificial intelligence across the entire product ecosystem.

The new Pixel 10, Pixel 10 Pro, Pixel 10 Pro XL, and the foldable Pixel 10 Pro Fold boast a range of AI-powered enhancements. These include a smart camera “coach” to guide users in taking better photos, and a proactive assistant that anticipates user needs, such as displaying a flight confirmation when a relevant airline is called.

The phones themselves retain a similar exterior design, although the base model now includes a telephoto lens previously only found on higher-priced models. Despite earlier concerns regarding potential price hikes due to US tariffs, the starting price remains at $799 for the base model and $1799 for the foldable version.

Google’s Tensor G5 processor powers all Pixel 10 models and, for the first time, incorporates Pixelsnap, a magnetic charging technology comparable to Apple’s MagSafe. This launch includes a variety of Pixelsnap-compatible chargers, cases, and stands. The Pixel Watch 4 and updated Pixel Buds 2a also received updates.

Google’s hardware event traditionally serves as a platform to demonstrate the potential of Android to device manufacturers and software developers, aiming to compete with Apple’s iOS.

While Android powers over 80% of global smartphones, Google’s Pixel line holds a small market share compared to competitors like Samsung and Xiaomi. Google’s focus remains primarily on the high-end market, with nearly three-quarters of Pixel shipments concentrated in the US, Japan, and the UK.

Despite last year’s shift to a summer launch to highlight AI advancements ahead of Apple, Google’s market share growth has been incremental. IDC reports that Google held 1.1% of the global smartphone market in Q2 2024, up slightly from 0.9% a year prior.

In the US, its largest market, Pixel’s share dipped to 4.3% from 4.5% during the same period. This suggests that Google’s AI focus, while innovative, hasn’t yet significantly boosted its market position.