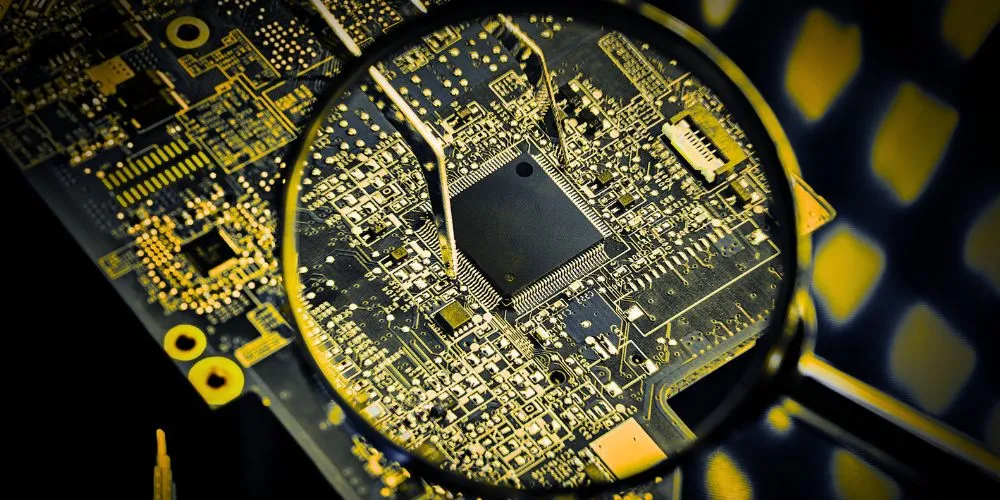

Semiconductors, also known as chips, are the brains behind every piece of modern technology, from smartphones and cars to data centers and military equipment. For a long time, the semiconductor industry was seen as highly cyclical, prone to booms and busts. However, today, with the rapid growth of AI and the increasing digitization of everything, chips have become as essential as oil. This has turned the semiconductor sector into a strategic, long-term investment theme.

The New Secular Growth Story

The old view of the chip industry was tied to the sales cycles of PCs and smartphones. When sales were up, chip stocks soared; when sales were down, they crashed. While those cycles still exist, a new, powerful driver has emerged: secular growth. The long-term trends of AI, cloud computing, electric vehicles, and the Internet of Things (IoT) all require an ever-increasing number of more powerful and specialized chips, creating a strong baseline of demand.

Understanding the Different Players

The semiconductor industry is a complex system, with various companies playing distinct roles. There are designers like NVIDIA (NVDA) and AMD (AMD) who design the chips. There are foundries like Taiwan Semiconductor Manufacturing Company (TSMC) that manufacture the chips for other companies. Then, there are companies like Intel (INTC) that both design and manufacture their chips. Understanding these various business models is crucial for investing in the sector.

The Geopolitical Chess Match

Semiconductors have become a key piece in the geopolitical chess match between the U.S. and China. The U.S. has implemented export controls to limit China’s access to advanced chip technology, aiming to slow its military and technological progress. This has created uncertainty, but it has also spurred massive government investments, such as the CHIPS Act in the U.S., to build more manufacturing capacity at home. This presents a significant opportunity for certain companies.

AI is a Game Changer

Artificial intelligence is consuming an astonishing amount of computing power, and that means a massive demand for advanced semiconductors. This isn’t just about the high-end GPUs from NVIDIA. It also drives demand for memory chips from companies such as Micron (MU) and the complex equipment used to manufacture chips from companies like ASML and Applied Materials (AMAT). The AI trend lifts the entire semiconductor ecosystem.

Investing in the Chip Ecosystem

Given the complexity and geopolitical risks, it may be wise to invest in the sector through an exchange-traded fund (ETF), such as the VanEck Semiconductor ETF (SMH). This provides you with broad exposure to the entire industry, encompassing designers, manufacturers, and equipment makers. If you’re picking individual stocks, focus on companies with clear technological leadership and strong financial health.

Conclusion

Semiconductors are no longer just a cyclical industry; they are the strategic foundation of the global economy. While risks remain, the powerful long-term demand driven by AI and digitization makes the semiconductor sector a compelling investment opportunity. Understanding the key players and trends can help you build a resilient position in this critically important industry.