Key Points

- Tesla’s share price has surged 159.83% in the past six months, with a recent 3.6% rise. However, pre-market trading currently shows a 3.05% drop.

- Mizuho upgraded Tesla’s price target to $515, citing regulatory and technological tailwinds.

- Analysts predict breakthroughs in FSD, Robo-Taxis, and Tesla’s Optimus robot. Analysts value Tesla’s AI and autonomous opportunities at over $1 trillion.

- The Trump administration may ease regulations on autonomous driving systems. Federal frameworks could accelerate Tesla’s growth initiatives.

Over the past six months, Tesla’s share price has surged by an impressive 159.83%. Yesterday, the stock saw a notable 3.6% increase, closing at a record $479.86 per share, marking a nearly 20% gain over the past five days. However, as of the latest update at 4:43 AM ET (09:43 AM GMT), Tesla’s share price in pre-market trading stands at $465.24, showing a decline of $14.62, or a 3.05% drop.

The surge comes as Wall Street analysts grow increasingly bullish on Tesla’s future, fueled by optimism surrounding potential regulatory changes under the incoming Trump administration. Tesla’s stock has climbed over 85% since Election Day, reflecting confidence in its leadership across electric vehicles (EVs), autonomous driving technologies, and energy solutions.

Mizuho Securities analyst Vijay Rakesh upgraded Tesla to “Outperform” from “Neutral” and doubled his price target to $515 from $230. Rakesh highlighted “idiosyncratic tailwinds,” including expectations that the Trump administration will loosen autonomous driving regulations and eliminate consumer EV tax credits, which he believes will benefit Tesla more than its competitors. Additionally, Tesla’s profitability in low-cost EV production and advancements in solar and battery storage solutions position it favorably to outperform less-established peers.

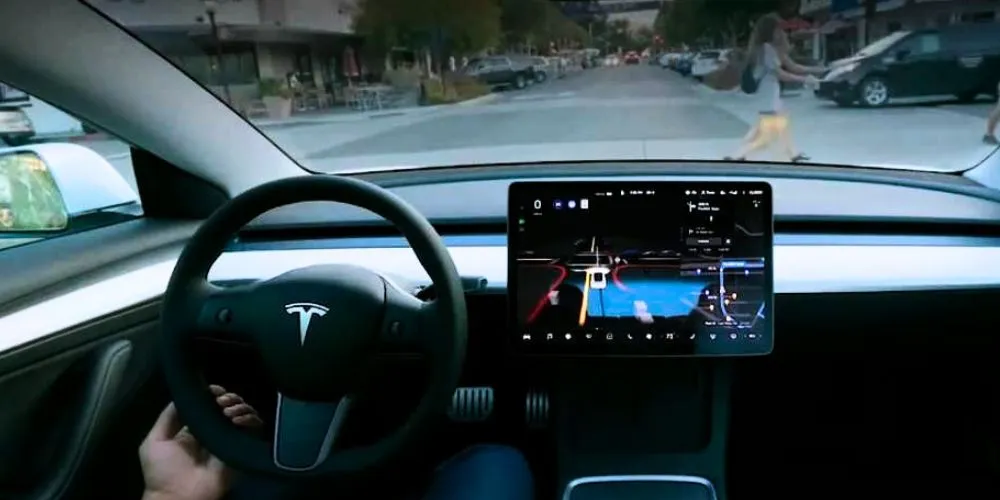

Rakesh’s analysis suggests that Tesla’s Full Self-Driving (FSD) and Robo-Taxi deployment could be key long-term revenue drivers, with a bull-case scenario pushing Tesla’s stock as high as $681 per share. He also cited potential breakthroughs in Tesla’s Optimus robot and AI development as further growth catalysts.

Wedbush analyst Dan Ives echoed this sentiment earlier in the week, valuing Tesla’s AI and autonomous opportunities at over $1 trillion. Ives raised his price target to $515, emphasizing that a Trump administration could accelerate key initiatives in autonomous vehicle regulation.

Reuters reports indicate that the new administration may eliminate a National Highway Traffic Safety Administration (NHTSA) order requiring automakers to report crashes involving self-driving systems. This regulatory shift would benefit Tesla, which has reported over 1,500 incidents involving Autopilot and FSD technologies. Bloomberg also reported that federal frameworks for autonomous vehicles could become a priority for the Transportation Department, easing the path for innovations like Tesla’s vehicles without pedals or steering wheels.

Analysts foresee substantial growth opportunities ahead as Tesla looks to scale its autonomous technologies and leverage policy changes.