For generations, buying a home was synonymous with a mountain of paperwork. The process was a rite of passage characterized by cramped hands from signing dozens of documents, hunting down physical bank statements, faxing tax returns, and sitting in a title company’s conference room for hours. It was slow, opaque, and often stressful.

However, the financial technology (fintech) wave that revolutionized how we hail rides, order food, and trade stocks has finally reshaped the mortgage industry. Enter the Digital Mortgage.

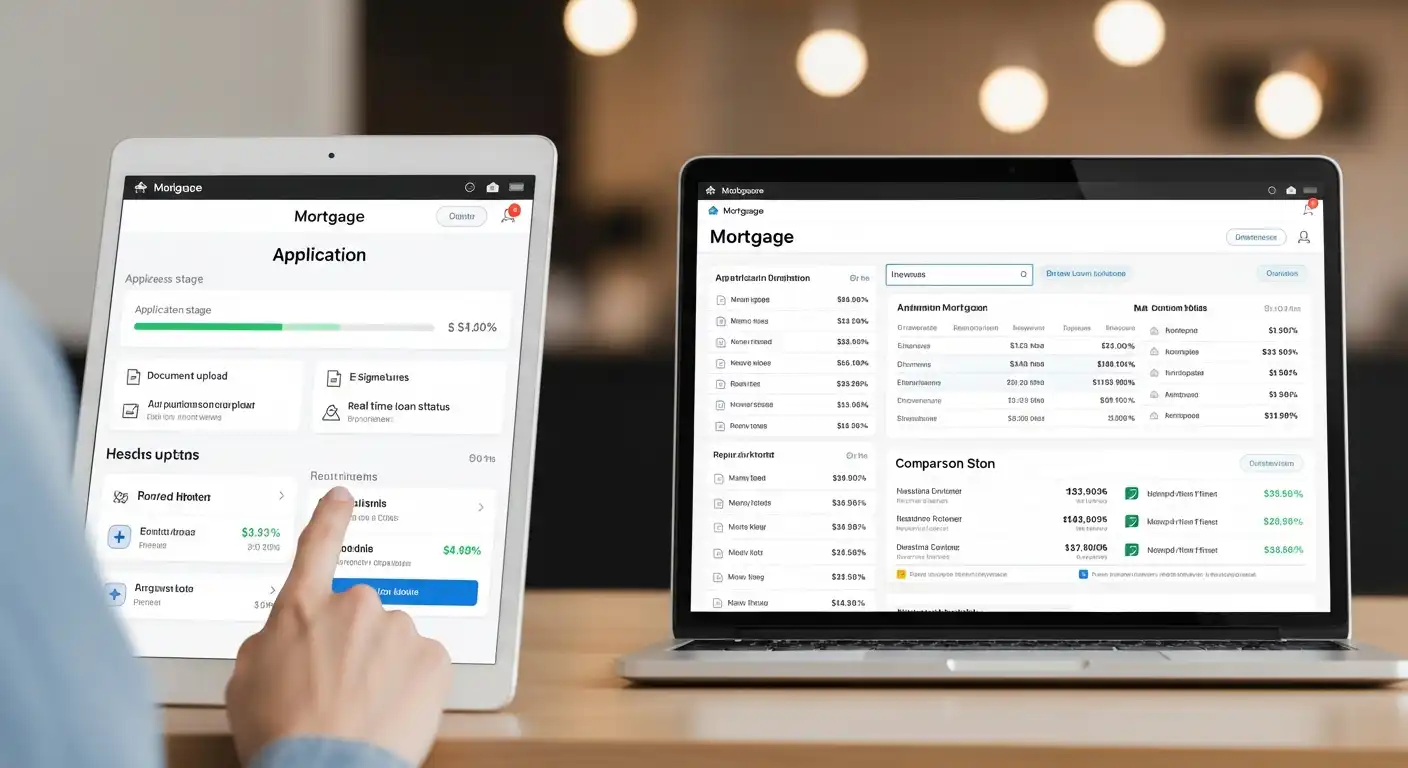

Today, it is entirely possible to apply for, process, and close a home loan without ever setting foot inside a bank or holding a physical pen. This transformation is not just about convenience; it is about accuracy, speed, and democratization of access to capital. As lenders race to adopt “eClosing” technologies and Remote Online Notarization (RON), the dream of a frictionless home-buying experience is becoming a reality.

This comprehensive guide explores the mechanics of digital mortgages, the technologies powering them, the pros and cons for borrowers, and the future of real estate financing.

Understanding the Digital Mortgage

A digital mortgage is a home loan in which most, if not all, of the process is conducted electronically. It replaces paper forms with digital data and manual review with automated algorithms.

While many banks claim to offer “online mortgages,” the level of digitization varies. Understanding where a lender falls on this spectrum is crucial for managing expectations.

The Spectrum of Digitization

- The Digital Application (Front-End Only): Many traditional banks allow you to fill out the initial application online. However, once you hit “submit,” the process reverts to traditional methods—a loan officer calls you, asks for PDF uploads of documents, and the underwriting is done manually.

- The Hybrid eClosing: In this model, the application, document submission, and processing are digital. You might sign initial disclosures electronically (eSign). However, the final closing ceremony requires a physical meeting with a notary to “wet sign” the promissory note and mortgage deed, often due to local county recording laws.

- The Fully Digital Mortgage (eMortgage): This is the “Holy Grail.” From the first click to the final signature, everything is electronic. Income is verified via data APIs, the appraisal might be automated, and the closing is conducted via a webcam with a remote notary. The final note is an “eNote” stored in a digital vault.

How the Process Works: From Click to Keys

The digital mortgage process streamlines the chaotic workflow of traditional lending into a linear, user-friendly experience. Here is a breakdown of the online loan lifecycle.

The Smart Application and Asset Verification

In the old days, you had to dig up three months of bank statements and pay stubs. In a digital mortgage, you grant the lender permission to access your financial data directly.

Using secure Application Programming Interfaces (APIs), the lender connects to your bank, your payroll provider (like ADP), and the IRS.

- Asset Verification: The system instantly pulls your account balances to verify you have the down payment.

- Income Verification: Instead of reading pay stubs, the system sees the direct deposits from your employer.

- Employment Verification: The system confirms you are currently employed.

This reduces fraud and eliminates the “I can’t find that document” delay.

Automated Underwriting

Underwriting is the process by which the lender assesses the risk of lending to you. Traditionally, a human underwriter would sit with a calculator and your file for days.

Digital lenders use Automated Underwriting Systems (AUS). These sophisticated algorithms analyze your credit score, debt-to-income (DTI) ratio, and loan-to-value (LTV) ratio in seconds. They can issue a “Pre-Approval” letter almost instantly, allowing you to make offers on homes with confidence. While a human may still review complex files, the “easy” approvals are handled by machines.

The Digital Appraisal

For a long time, the appraisal was the bottleneck. A human inspector had to inspect the property physically. While physical appraisals are still common, digital mortgages increasingly rely on:

- Desktop Appraisals: An appraiser values the home based on data and photos without visiting the property.

- Automated Valuation Models (AVMs): Similar to Zillow’s “Zestimate,” these algorithms use comparable sales data and public records to instantly determine value.

The eClosing and Remote Online Notarization (RON)

The final step is the closing. In a fully digital environment, this utilizes Remote Online Notarization (RON).

- You log in to a secure portal via a video conferencing tool.

- You verify your identity by answering knowledge-based authentication questions (e.g., “Which of these streets did you live on in 2010?”) and uploading a photo of your ID.

- A licensed notary appears on the screen.

- You sign documents electronically while the notary witnesses the act digitally.

- The notary applies an electronic seal.

The Technology Under the Hood

A complex technology stack powers the seamless digital mortgage experience.

Optical Character Recognition (OCR) and AI

Even in a digital process, some documents (such as a gift letter or a divorce decree) may be uploaded as PDFs. Lenders use OCR technology to “read” these documents, converting images of text into data that the system can process. Artificial Intelligence (AI) then categorizes these documents, ensuring that a tax return isn’t mistaken for a bank statement.

Blockchain and Distributed Ledger Technology

While still in its infancy in the mortgage sector, blockchain promises to revolutionize title searches. Currently, proving who owns a home involves searching dusty county records. If property deeds were stored on a blockchain—an immutable, transparent ledger—title transfers could occur instantly, significantly reducing closing costs.

API Connectivity

The real hero of the digital mortgage is the API (Application Programming Interface). APIs enable different software systems to communicate with each other. They connect the lender’s specialized software (Loan Origination System) to credit bureaus, bank servers, and title companies, creating a data flow network that replaces physical couriers.

The Benefits of Going Digital

Why are borrowers flocking to fintech lenders and digital banks? The advantages are tangible.

Unparalleled Speed

The average time to close a traditional mortgage is often 45 to 60 days. Digital lenders frequently close loans in 15 to 20 days. In a hot real estate market where sellers prioritize speed, having a digital lender can be the difference between getting the house or losing it.

Enhanced Transparency

Traditional borrowers often describe a “black hole” period where they submit documents and hear nothing for weeks. Digital mortgage portals provide real-time status trackers. You know exactly when the appraisal was ordered, when the underwriting is complete, and if any documents are missing.

Reduced Errors

Manual data entry is prone to human error. A loan officer might mistype a Social Security number or miscalculate income. By pulling data directly from the source (the bank or IRS), digital mortgages maintain data integrity, reducing the risk of last-minute delays caused by paperwork errors.

Convenience and Accessibility

You can apply for a mortgage on your tablet at 11:00 PM on a Sunday. There is no need to take time off work to visit a bank branch. This democratizes access, making it easier for people with rigid work schedules or mobility issues to access financing.

The Challenges and Risks

Despite the slick interface, digital mortgages are not without potential downsides.

The “Cookie Cutter” Borrower

Automated underwriting is fantastic if you have a W-2 job, a good credit score, and money in a standard bank account. It struggles with complexity.

- Self-Employed Borrowers: If you are a freelancer with complex tax write-offs, an algorithm might deny you because your “net income” looks low, even if your cash flow is high.

- Gig Economy Workers: Irregular income streams can confuse automated systems.

- Unique Properties: Algorithms struggle to value unique homes (like a converted barn or an off-grid cabin) because there are no comparable data points.

In these cases, the “human touch” of a traditional loan officer who can build a narrative for the underwriter is invaluable.

Cybersecurity Concerns

Aggregating all your financial life—tax returns, bank passwords, Social Security numbers—into a single portal creates a high-value target for hackers. While lenders use bank-grade encryption, the risk of a data breach is a valid concern for digital consumers.

The Lack of Guidance

A mortgage is likely the largest debt you will ever take on. A digital interface might be easy to use, but it won’t advise you. It won’t tell you that an Adjustable Rate Mortgage (ARM) is not a good fit for your specific long-term goals. First-time homebuyers often benefit from the mentorship of an experienced loan officer, which can be lost in a purely digital transaction.

Key Players in the Digital Mortgage Space

The market is a battlefield between “disruptors” and “adapters.”

The Fintech Disruptors

Companies like Rocket Mortgage (formerly Quicken Loans) and Better.com pioneered this space. They built their technology stacks from scratch, prioritizing the user interface. They operate without branches, passing some operational savings to consumers.

The Traditional Adapters

Big banks like Chase, Wells Fargo, and Bank of America were initially slow to adapt but have caught up. They now offer robust digital dashboards. Their advantage is the “omnichannel” approach—you can start online but walk into a branch if you get stuck.

The Wholesale Tech Providers

Most local credit unions and mortgage brokers don’t build their own software. They license technology from giants like ICE Mortgage Technology (Encompass) or Blend. These companies provide the backend infrastructure that allows a small local lender to offer an application experience that rivals Rocket Mortgage.

Regulatory Landscape: The E-SIGN Act and Beyond

A legal framework supports the shift to digital, though laws vary by state.

The E-SIGN Act (2000)

The federal Electronic Signatures in Global and National Commerce Act established that electronic signatures are legally binding as wet-ink signatures. This is the bedrock of the digital mortgage.

The Patchwork of RON Laws

Remote Online Notarization (RON) is not legal in every state, though the COVID-19 pandemic accelerated adoption. Some counties still require a “wet-ink” signature on the mortgage deed because their recording offices are not set up to accept digital files. This creates a hurdle: a lender might be fully digital, but the local government requires a paper closing.

Security Best Practices for Digital Borrowers

If you choose a digital mortgage, you are responsible for your data security.

- Two-Factor Authentication (2FA): Always enable 2FA on your lender’s portal.

- Avoid Public Wi-Fi: Never upload financial documents or link bank accounts while using unsecured public Wi-Fi.

- Verify the URL: Phishing scams are common. Ensure you are on the lender’s legitimate site before entering credentials.

- Read the e-Documents: It is easy just to click “Next, Next, Sign” on a screen. Force yourself to stop and read the Loan Estimate and Closing Disclosure just as carefully as you would paper documents.

The Future of Home Financing

We are currently in the transition phase (“Web 2.0”) of digital mortgages. The future (“Web 3.0”) looks even more integrated.

The “One-Click” Mortgage

As Open Banking regulations mature (giving consumers ownership of their financial data), we may reach a point where a mortgage is pre-approved before you even look for a house. Your digital wallet will constantly broadcast your borrowing power.

AI-Driven Personalization

Future algorithms won’t just approve or deny; they will advise. AI will analyze your spending habits and suggest: “Based on your spending, a 15-year mortgage will strain your monthly budget. We recommend a 30-year term to maintain your lifestyle.”

Smart Contracts

Eventually, the mortgage agreement itself could be a Smart Contract on a blockchain. This would automate payments. If you pay off the loan, the smart contract automatically releases the lien on the title instantly, without human intervention.

Conclusion

The digital mortgage is no longer a niche product for tech-savvy millennials; it is now the industry standard. It offers a faster, cleaner, and more transparent way to navigate the most significant financial transaction of a lifetime.

While it creates challenges for non-standard borrowers and demands high cybersecurity standards, the trajectory is clear. The days of the wrist-cramping closing ceremony are numbered. Whether through a fintech giant or a local bank using modern software, your next home loan will likely be closed not with a handshake and a pen, but with a click and a smile.