Key Points

- Exxon Mobil and Chevron reported record oil production in Q3, offsetting weaker fuel margins.

- Exxon’s acquisition of Pioneer Natural Resources and Chevron’s purchase of PDC Energy significantly boosted production.

- Exxon’s profits dropped by 5% and Chevron’s by 21%, but both fared better than European competitors BP and TotalEnergies.

- Exxon and Chevron exceeded Wall Street’s earnings estimates, leading to a stock price increase.

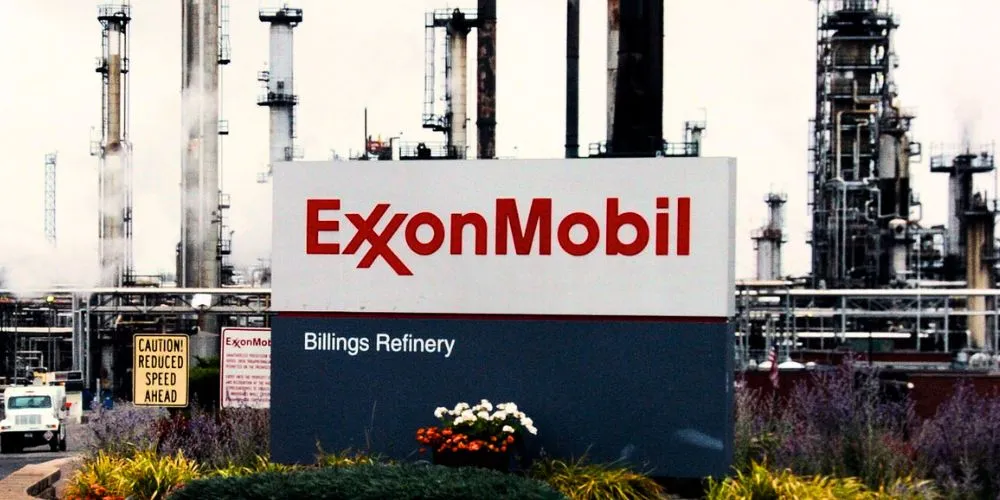

On Friday, U.S. oil giants Exxon Mobil (XOM.N) and Chevron (CVX.N) reported better-than-expected third-quarter earnings. Both companies outperformed their European counterparts due to record oil production, which helped offset a decline in fuel margins. Unlike European competitors such as BP (BP.L) and Shell (SHEL.L), which have heavily invested in renewable energy sources like wind and solar, Exxon and Chevron have focused on boosting oil and gas output, supported by recent acquisitions.

Exxon Mobil reported a 24% increase in oil production compared to the same quarter last year, reaching a record 4.6 million barrels of oil equivalent per day (boepd). This growth was largely fueled by the company’s $60 billion acquisition of Pioneer Natural Resources and the purchase of Denbury. Meanwhile, Chevron saw a 14% rise in output to a record 1.61 million boepd, largely driven by gains in its U.S. shale operations, including adding a new drilling rig in the Permian Basin and planned expansion in Kazakhstan.

Despite the significant increase in production, both companies experienced a year-over-year drop in profits due to weaker refining margins. Exxon’s third-quarter profit fell by 5%, while Chevron’s dropped by 21%. However, these declines were milder than those reported by European competitors; BP posted a 30% profit decline, while TotalEnergies (TTEF.PA) saw a 37% decrease in adjusted net income.

Exxon reported a profit of $1.92 per share, slightly surpassing Wall Street’s forecast by four cents. Chevron achieved an adjusted income of $2.51 per share, exceeding analyst estimates of $2.42. This news boosted both companies’ shares by nearly 2% in premarket trading.

Exxon and Chevron achieved record production levels from the Permian Basin, with Exxon’s output reaching 1.4 million boepd and Chevron’s rising 22% to 950,000 boepd. Chevron expects to reach 1 million boepd in the Permian Basin by next year, largely due to its acquisition of PDC Energy.

The companies may face challenges due to uncertain global oil demand, especially from China, and the potential for OPEC to adjust production limits in response to oversupply concerns. Nevertheless, Exxon’s finance chief Kathryn Mikells expressed optimism, stating that the company sees “tremendous opportunities” for profitable growth in current and emerging ventures.